Your Starter Guide To Proof of Stake Networks, Staking Pools, and Liquid Staking Derivatives

BCB X LSD

Staking and Proof Of Stake Networks Basics

Blockchains rely on validator nodes coming to a consensus in order to record transactions on-chain.

In a Proof of Stake network, these validators are required to stake a set amount of the chain’s native token in order to participate in the consensus layer.

Requiring validators to put their capital at risk accomplishes the following:

The consensus mechanisms of the blockchain are centered around staked capital instead of energy-consuming computational power.

Validators are rewarded, usually through the native token, and thus network participants are incentivized to become validators. Networks become physically and financially more secure as more people run their own validator nodes. Spreading out physically combined with increasing the amount of capital required for a 51% attack effectively drives networks deeper into the spectrum of decentralization.

Validator operators are incentivized to act in the best interest of the network or else their capital will be slashed through built-in smart contract mechanisms.

Staking Ethereum

State Of The Network

~16,000,000 ETH staked

~$22.8 Billion staked

~498,000 validator nodes

5.1% APR rewarded to validators

The “Shanghai” network upgrade enabling the withdrawal of staked $ETH is scheduled for the first half of 2023.

Run Your Own Node

Solo-staking or running your own validator node on the Ethereum network requires 32 ETH, a dedicated computer with 24/7 service and power, and a reasonable amount of technical know-how. The advantages are that you own full control of your capital, you do not have to trust an outside service, and you are maximizing your contribution, as an individual, to the decentralization of the network.

Participate In A Staking Service

Ready to stake your 32 ETH but want to outsource the technical part?

See the new SaaS; it’s Staking as a Service now.

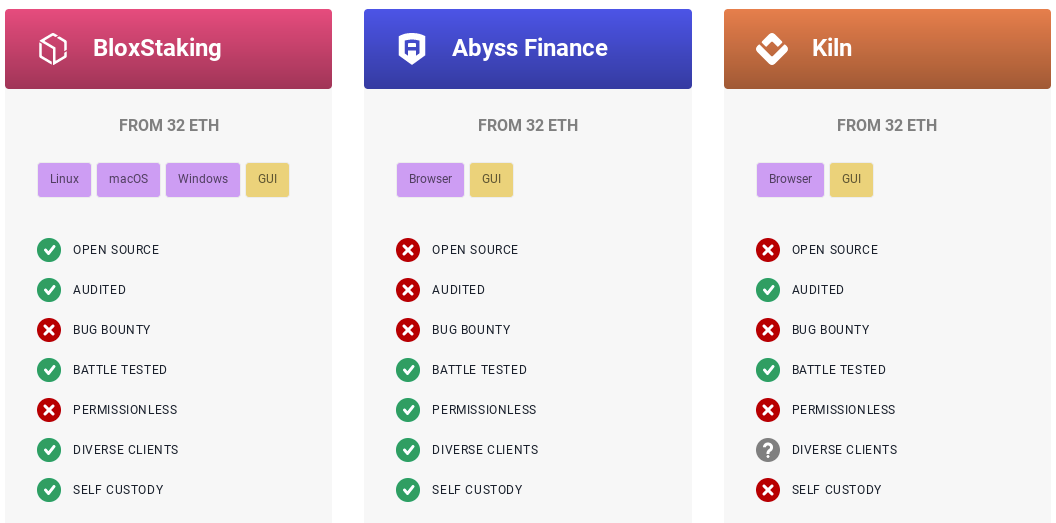

Image from ethereum.org/en/staking/solo/

Enter Staking Pools

Are you a normal person in 2023 owning less than 32 ETH but you’re becoming strangely excited about staking ETH? Are you interested in simplifying your staking investments across multiple PoS networks?

Good news, there are hundreds of protocols fighting for your business.

Staking Pools refer to combining multiple users’ assets to support the minimum stake of a validator. Protocols running these pools offer financial and technical accessibility for users; usually in exchange for ~10% of staking yields.

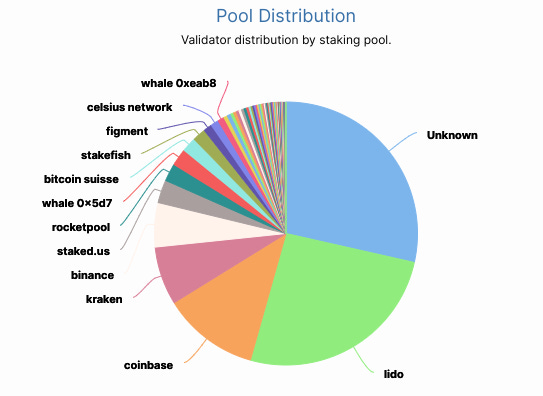

Imagery below, from beaconcha.in, demonstrates the top staking pools and services for Ethereum.

Key Insights:

Lido runs 25% of staked ETH through their validator partners. This is not as decentralized as individuals owning each node, however Lido provides impressive data on the decentralization of their network of validator partners.

The “Others” category represents 28% of the network. These are individuals and small partner pools.

Coinbase, a centralized entity, where users give up custody of their funds, holds 11% of all staked ETH. Hardly ideal for decentralization. The upside is that Coinbase is a publicly traded, U.S.-based and regulated entity with a track record of supporting decentralization and defi products.

Liquid Staking and LSD Protocols

Liquid staking refers to readily tradable (liquid) tokens that represent staked (locked, illiquid) tokens in PoS networks.

Liquid Staking Derivative Protocols are the businesses offering these liquid tokens, in exchange for part of your natively staked token’s yield.

How It Works:

Users deposit their chain native token to the LSD Protocol’s smart contract. (Hopefully in a friendly user interface.)

The smart contract stakes the native token.

The LSD Protocol’s treasury receives the native staking rewards and distributes them to validators, users, and usually another protocol wallet.

Users typically give up 10% of native staking rewards, to be split by the validators and protocol, in exchange for getting their liquid derivative token, which is backed by the natively staked token.

Users can take that liquid derivative token and sell it or deploy it in other defi protocols and liquidity pools to earn yield. The idea is that this yield + the 90% of native staking yield is greater than the 100% of native staking yield users could achieve on their own.

Key Considerations In Choosing LSDs:

Tokenomics, specifically the token inflation schedule, affect the value of derivative tokens. Are rewards based on native staking real yield or are yields being padded with inflationary minting?

The protocol revenue model provides key insights into the sustainability of the business. Some staking services have an entire suite of defi products. Look for loss leaders and inflationary helpers.

The current market cap and fully diluted market cap present the state of the business relative to the macro environment and an idea of its inflationary future.

Doing business with any protocol means exposure to smart contract risk. Look for quality audits, bug bounty programs and team history.

Depeg risk is always a possibility with derivative assets. This means the stTOKEN value loses value relative to its backing token. This can happen during withdrawal and liquidity crises.

Rebase rewards lead to income tax while indexed value accrual mechanisms lead to capital gains tax. Think about the frequency and type of taxable events you prefer exposure to.

Consider the use cases and liquidity available for the stTOKEN provided by your chosen LSD platform. Yield opportunities and liquidity for any given stTOKEN are the key reasons to utilize LSDs.

Top Liquid Staking Derivative Protocols

Lido Finance

Stakers:

~252,600

Liquid Staking APR By Chain:

Ethereum 4.8%

Polygon 6.3%

Polkadot 15.6%

Solana 6.5%

Kusama 14.4%

Liquid Tokens:

stETH

stMATIC

stDOT

stSOL

stKSM

Revenue Model:

10% of native staking rewards

Rocket Pool

Validator Nodes:

~1,948

Liquid Staking APR By Chain:

Ethereum 4.2 - 7.3%

Yield depends on size of the position and matching RPL stake.

Liquid Tokens:

rETH

Governance Token:

RPL

Revenue Model:

RPL Inflation.

RPL inflation will initially be 5% per annum (per year) and will be split up amongst:

-Node Operators who stake RPL as insurance collateral (70%) - this works because node operators must match their ETH stake with RPL stake by 10-150%, therefore the ecosystem guarantees the majority of RPL has buying and locking pressure.

-Oracle DAO members providing various oracle data (15%)

-Protocol DAO Treasury to fund decentralized development (15%)

Stakewise

Validator Nodes:

2000+

Liquid Staking APR By Chain:

Ethereum 4.7%

Liquid Tokens:

sETH2 - represents staked tokens

rETH2 - represents reward tokens

Both tokens represent Eth 1:1

Stakewise separates the receipt tokens for user deposits and rewards, enabling users to deploy different strategies and risk tolerances for each asset. This is unique and I tend to accept greater risk for reward token strategies than I do for anything representing my initial principal.

Revenue Model:

10% native staking rewards

Ankr

Stakers:

ETH 6,219

MATIC 1,170

BNB 971

FTM 366

AVAX 1,046

DOT 118

Liquid Staking APR By Chain:

Ethereum 3.9% Polygon 4.3% Binance 2.3%

Fantom 3.6% Avalanche 7.3% Polkadot 6%

Liquid Tokens:

ankrETH

ankrMATIC

ankrBNB

ankrFTM

ankrAVAX

aDOTb

Governance Token:

ANKR

Revenue Model:

ANKR network fees and entire suite of defi products.

Stader Labs

Stakers:

70,000+

Chains supported and user APR:

Polygon 5.7%

Hedera 8.49%

Fantom 4.7%

Binance 3.1%

Terra 16.1%

Near 10.2%

Ethereum - Soon

Liquid Tokens:

MATICx

HBARx

sFTMx

BNBx

LUNAx

NEARx

ETHx - Soon

Revenue Model:

10% of native staking rewards

10% management fee across other defi products

Subscribe and look for Monday’s edition full of liquid staking strategy!

Disclaimer: Opinions here are my own. None of this is financial or investment advice. You should always do your own research, form your own opinions and make your own decisions.