Leverage on Arbitrum, Innovative DeFi Risk Management and NFT Finance.

Blue Collar Blockchain #5

DeFi

gTrade is live on Arbitrum - A Degen’s Dream

gTrade offers crypto, stock and forex trading with high leverage and low fees enabled by Arbitrum’s rapidly growing L2 infrastructure.

If you’re used to trading with centralized entities and high management fees - do the work to feel comfortable here and enjoy an objectively superior platform.

Poi$on.Finance Token shows classic pump and dump price action after private sale

The chart below represents a 30-hour period. You can tell when the private sale ended because of the irrational green candles immediately after. I watched the on-chain activity and noticed several of the same wallets constantly trading so my guess is that bagholders were pumping the volume (buying and selling a lot) and taking profits all the way up.

Disclaimer: I have not yet looked further into who is involved or if the protocol looks particularly promising. I simply want to illustrate why everyone chases whitelists, private sales, and “being early.” If this protocol is promising and built a momentous community, then the early adopters had an opportunity to 4x their private sale investment and remain at +2x after the initial craziness. That’s amazing.

If it’s a scammy pump and dump, it still held opportunity (albeit extremely risky) for those early degens lurking discord and throwing their wallets at private sales. I don’t find this kind of degen gambling unethical, I put that on teams and leadership.

Image from dextools.io

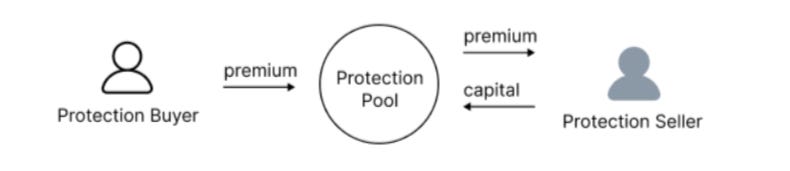

Carapace Finance innovates default risk in defi

Images from carapace.finance

-Defi protocols can work with Carapace Finance to offer default risk protection in undercollateralized setups

-Carapace Finance users can lend money to these undercollateralized protocols to earn risk-adjusted yield.

-If defi is really going to replace banking it needs to compete in capital efficiency meaning it needs leverage. Protocols have to lend more money than deposits secured, just as banks do. Carapace Finance offers a tool to manage collateralization risks.

- I think capital efficiency, collateralization, and automated risk management will grow into significant narratives throughout 2023.

NFTfi

That’s right, NFTfi as in NFT finance. This rapidly growing sector combines NFTs, fractional ownership, defi lending protocols, risk management, automation, and cross-chain infrastructure to cement itself as the most perplexing and exciting vertical in NFTs.

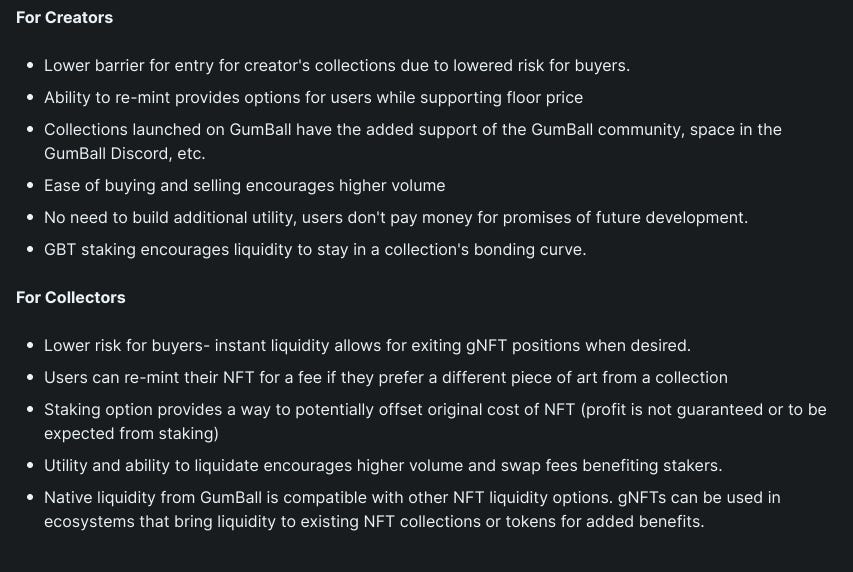

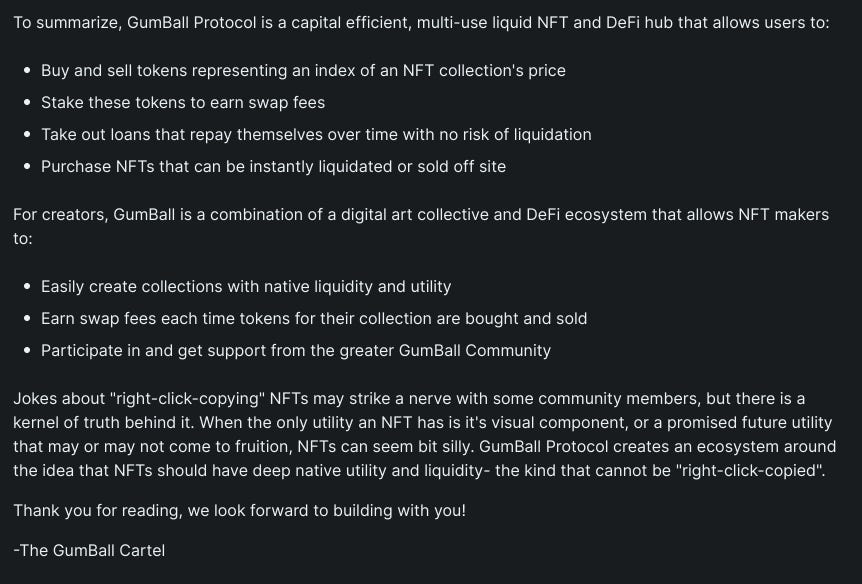

The GumBall Protocol brings NFTfi to Arbitrum

The LiquiCats will be fully $Eth backed to enable yield farming and fast, liquid trading.

Liquidity, utility, and entertainment will be the baseline requirements in NFT enthusiasts’ minds.

Images from gumball.fi

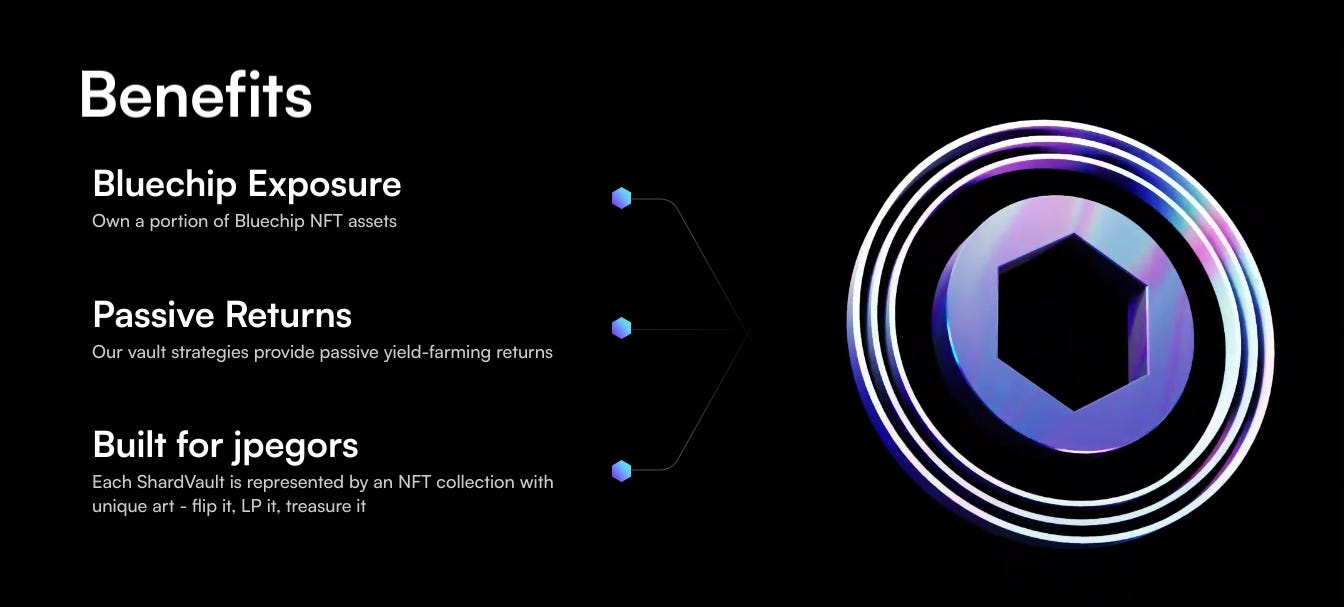

Insrt Finance combines fractional NFT ownership and defi lending to bring liquidity and yields to NFT collectors

Here’s your chance to finally gain ownership of a Crypto Punk and use it as an asset in defi.

Images from insrt.finance

Polygon targets “PFPs & art” going into 2023

Do not sleep on Polygon’s business development team. They own that FAFO scale right now.

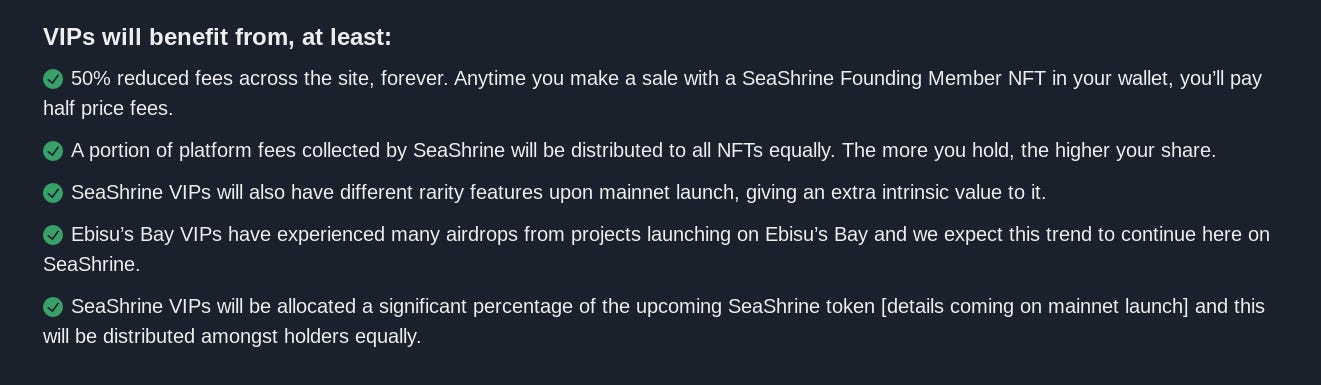

New NFT marketplace, SeaShrine on Aptos, goes live Wednesday

Mint your VIP Founding Member piece - getting serious Gyarados vibes here

Image from SeaShrine.io

Disclaimer: Opinions here are my own. None of this is financial or investment advice. You should always do your own research, form your own opinions and make your own decisions.