DeFi Takes Over

The Fantom Virtual Machine (FVM) Aims To Scale Beyond Ethereum

Key Points:

Virtual Machines on blockchains empower smart contracts and decentralized applications (dapps).

Ethereum’s virtual machine is limited to 17 transactions per second, this is why you see Layer 2s building on top of Layer 1s like Ethereum. Layer 2s conduct batches of transactions and then send them all as 1 transaction to their layer 1 foundation, creating scaling capability. Fantom wants to be more scalable as a layer 1 blockchain with its Fantom Virtual Machine.

The FVM aims to achieve scalability, decentralization of the network, and seamless integration for dapps in order to keep up with crypto adoption and use cases.

The FVM will be compatible with the Solidity programming language to make it easy for dapp builders to deploy their Eth-compatible dapps on the Fantom network.

The Fantom Foundation Has 30 Years Of Runway

NFTS

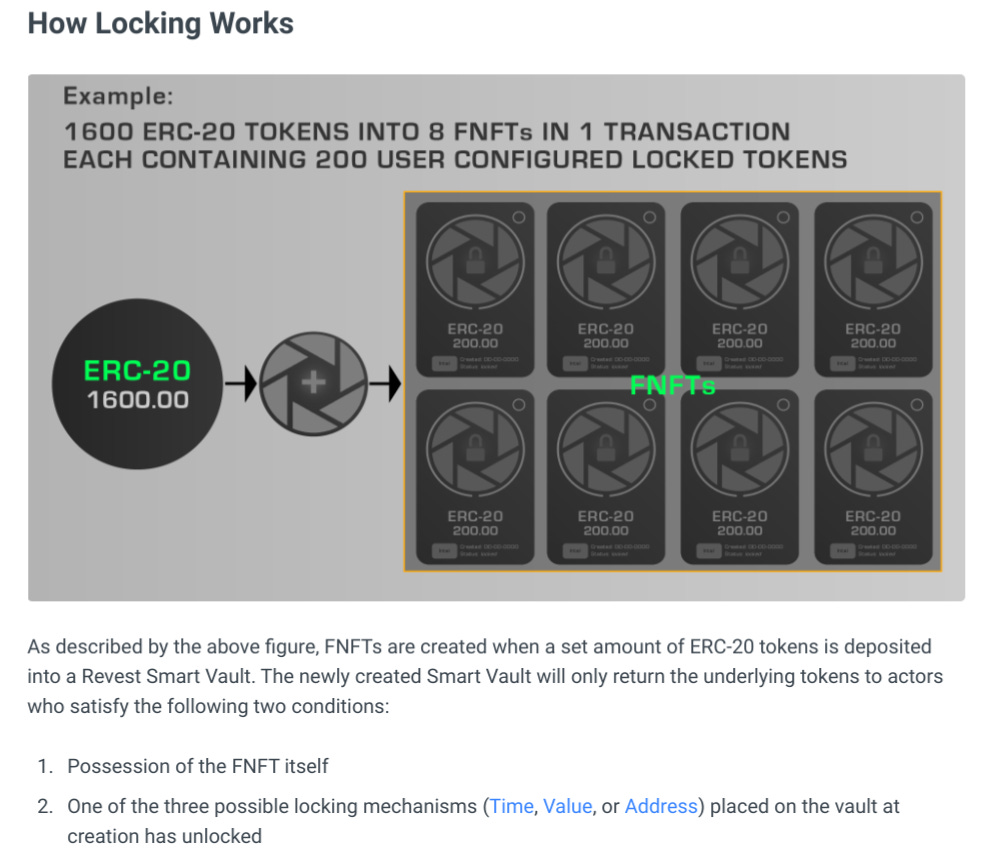

Revest Finance Builds Financial NFTs, Creating New Asset Class

Images from docs.revest.finance

Upfront Instant Yield With Resonate And Financial NFTS

Nullifying Nonsense

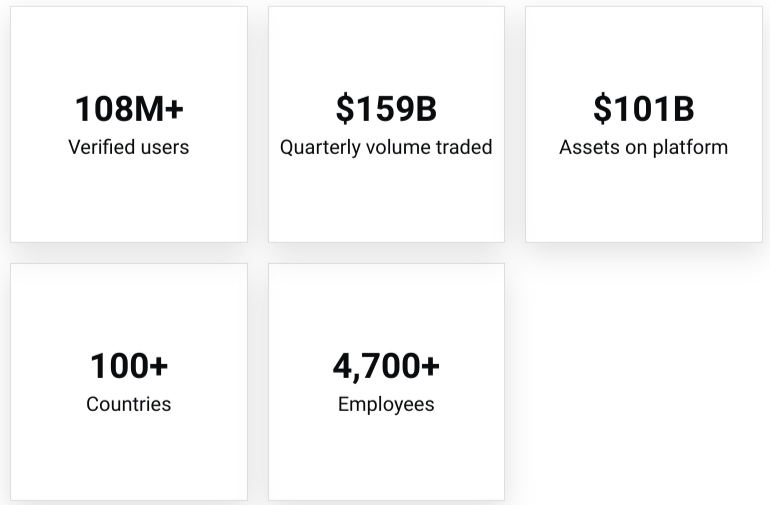

Coinbase operates under strict U.S. regulation, and still empowers defi users.

Brian Armstrong started Coinbase in June of 2012 when Bitcoin was trading around $5, long before most of us got excited about crypto. Today, Coinbase is a publicly traded company, with a market cap of over $9 billion, in the United States, while the majority of its competitors remain scared offshore.

As a result of being a public company, there is constant noise surrounding Coinbase.

Yes, the stock is down 85% year to date and the company has implemented cost-cutting to the tune of 1,100 layoffs in 2022. Coinbase cannot avoid the bear market. These are obvious pain points.

Here are some impressive points.

Image from coinbase.com

As a centralized entity in the primary business of securing custody of crypto and crypto trading volume, Coinbase still created the Coinbase Wallet: a powerful self-custodial wallet that easily interacts with defi protocols across all EVM-compatible networks in both a browser extension and a mobile app.

If a user converts their fiat currency into crypto in any other app and then sends that crypto to their Coinbase Wallet to use across their favorite defi protocols, then Coinbase doesn’t make any money on that user. Power move.

And still, they will make their money on most U.S. users who enjoy the simplicity of the platform.

I’d hate to compete with a company serving people this powerfully.

Brian Armstrong, CEO of Coinbase, brings reason to crypto regulation.

Onto the most recent impressive news surrounding Coinbase leadership: on December 19th, CEO Brian Armstrong shared a crypto regulation memo with his 1.1M followers on Twitter.

Key Points:

The U.S. needs to lead the way and create regulatory clarity for centralized actors to include stablecoin issuers, exchanges, and custodians. These three examples represent critical use cases for crypto and currently the most damning history of consumer harm, it’s time for KYC (know your customer) requirements and a level international playing field.

Congress needs to step up and create legislation around a modern-day Howey Test for crypto. The CFTC and SEC have provided zero clarity to the market after several years of reaching for authority and credibility through painful debate.

Self-custodial wallets empower people to hold their assets without the need to trust anyone else, only the smart contract. This combined with technological improvements in social recovery offers new levels of consumer protection with no third party to worry about. There is no ethical incentive to regulate against this.

Smart contracts, open-source code, and on-chain accounting take Google’s famous “don’t be evil” phrase to new heights of, “can’t be evil.” U.S. regulators would be wise to incubate this kind of innovation rather than regulate it away.

Read Brian Armstrong’s Full Blog On Crypto Regulation Here

My bet is that Brian Armstrong represents precisely what it takes to have longevity in business and decentralized finance.

Other Takes:

Affiliate Alert!

Web3nomads.jobs Helps You Recruit Crypto Talent

Disclaimer: Opinions here are my own. None of this is financial or investment advice. You should always do your own research, form your own opinions and make your own decisions.